On Wednesday (October 21), FinTech startup Mode Global Holdings PLC (“Mode”) announced that it had become the first publicly listed company (PLC) in the UK to adopt Bitcoin as a treasury reserve asset.

The grand vision of Mode, which was founded in 2019 and incorporated on 5 August 2020, is “to build a next-gen ecosystem that combines the best of banking, payments, investments, loyalty and digital assets.”

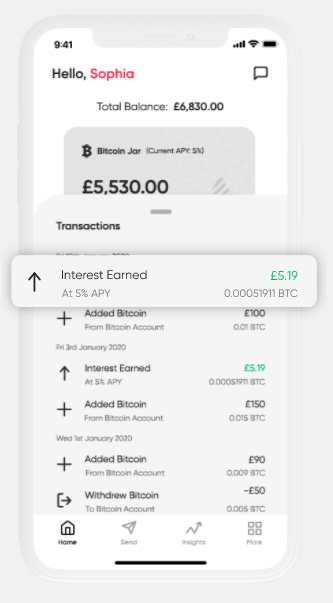

Last year, the company created the Mode App (now called “The Bitcoin Jar“), a mobile app that makes it very easy to buy, sell, and hold Bitcoin. More interestingly, the Bitcoin Jar app allows the user to grow their BTC holdings.

According to Mode’s press release, it has “allocated up to ten percent (10%) of its cash reserves to purchase Bitcoin and adopt it as a treasury reserve asset.” Mode says that this move is part of its “long-term goal to protect investors’ assets from currency debasement.”

Also, with UK interest rates at record low levels, Mode wants “to diversify away from low-interest money market instruments in order to maximise the value of returns from its recent fundraising.”

Mode goes on to say that it is “one of the first companies with a consumer-facing Bitcoin offering to list on the LSE Main Market.”

Jonathan Rowland, Executive Chairman at Mode, had this to say:

“This decision to allocate part of our cash reserves to Bitcoin is a further step in our mission to build a truly digital financial services business, combining the best of digital assets, payments, loyalty and investment.

“We truly believe that Bitcoin is a vehicle for financial empowerment and, through Mode, investors can gain exposure to this highly attractive asset class through a listed and fully compliant company.

“Faced with the challenges of COVID and with UK interest rates at the lowest level in the Bank of England’s 326-year history, our confidence in the long-term value of Bitcoin has only increased.

“Today’s allocation is executed through a modern, forward-looking but prudent treasury management strategy.”

cryptoglobe.com

cryptoglobe.com