Ethereum’s price has been correcting over the last few weeks following a decisive rejection from the $4,000 resistance level back in March. Yet, the market might be about to make a U-turn.

Ethereum Price Analysis: Technicals

By TradingRage

The Daily Chart

On the daily chart, the price has been forming a large descending channel pattern since the beginning of the correction. The lower boundary of the channel has recently been tested and pushed ETH to the upside.

The market has also held above the $3,000 support level, and investors are hoping for a rally toward the $3,600 resistance zone in the short term. Yet, so long as the channel remains intact, a further bullish continuation cannot be expected.

The 4-Hour Chart

The 4-hour chart further clarifies the recent price action. It is evident that the $3,000 support level has prevented the price from dropping any lower, and the market is forming a bottom.

The cryptocurrency is currently running toward the midline of the descending channel, and a breakout above would pave the way for the price to attack the $3,600 resistance level once again. With the Relative Strength Index showing values above 50%, the momentum is also in favor of a bullish move in the next few days.

Sentiment Analysis

By Shayan

Ethereum Open Interest

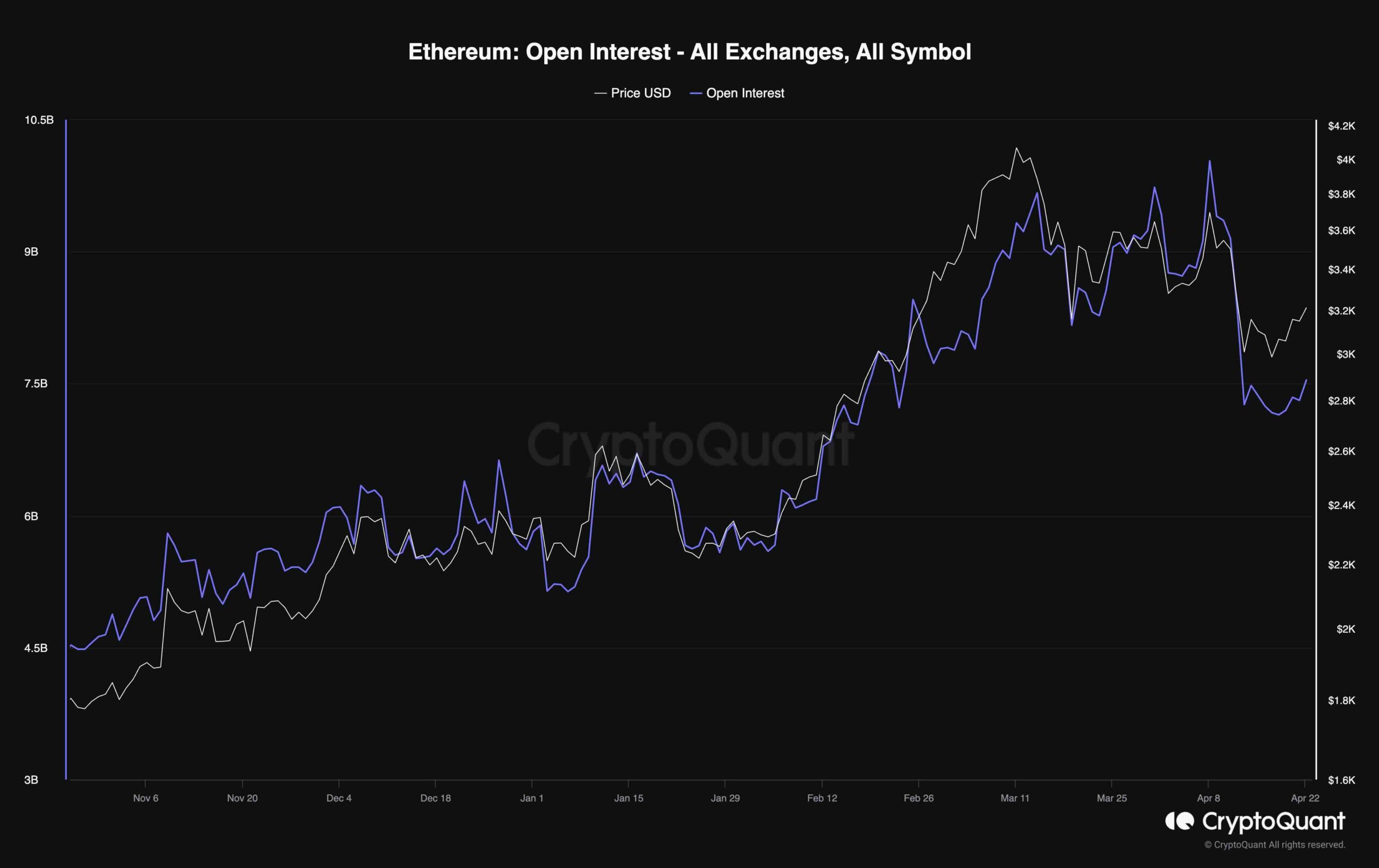

The impact of futures market sentiment on significant price movements cannot be underestimated, as the intensity of long and short positions, coupled with the possibility of substantial liquidations, serves as a primary catalyst for market volatility.

A crucial indicator in assessing this sentiment is Open Interest, which quantifies the number of open perpetual futures contracts across various cryptocurrency exchanges.

In light of Ethereum’s recent downtrend, it is noteworthy that the Open Interest metric has followed a similar trajectory, experiencing a substantial decline. This alignment suggests a slowdown of activity within the futures market.

Consequently, ETH appears poised for the resurgence of either long or short positions, potentially initiating a fresh and decisive market movement in either direction.

cryptopotato.com

cryptopotato.com