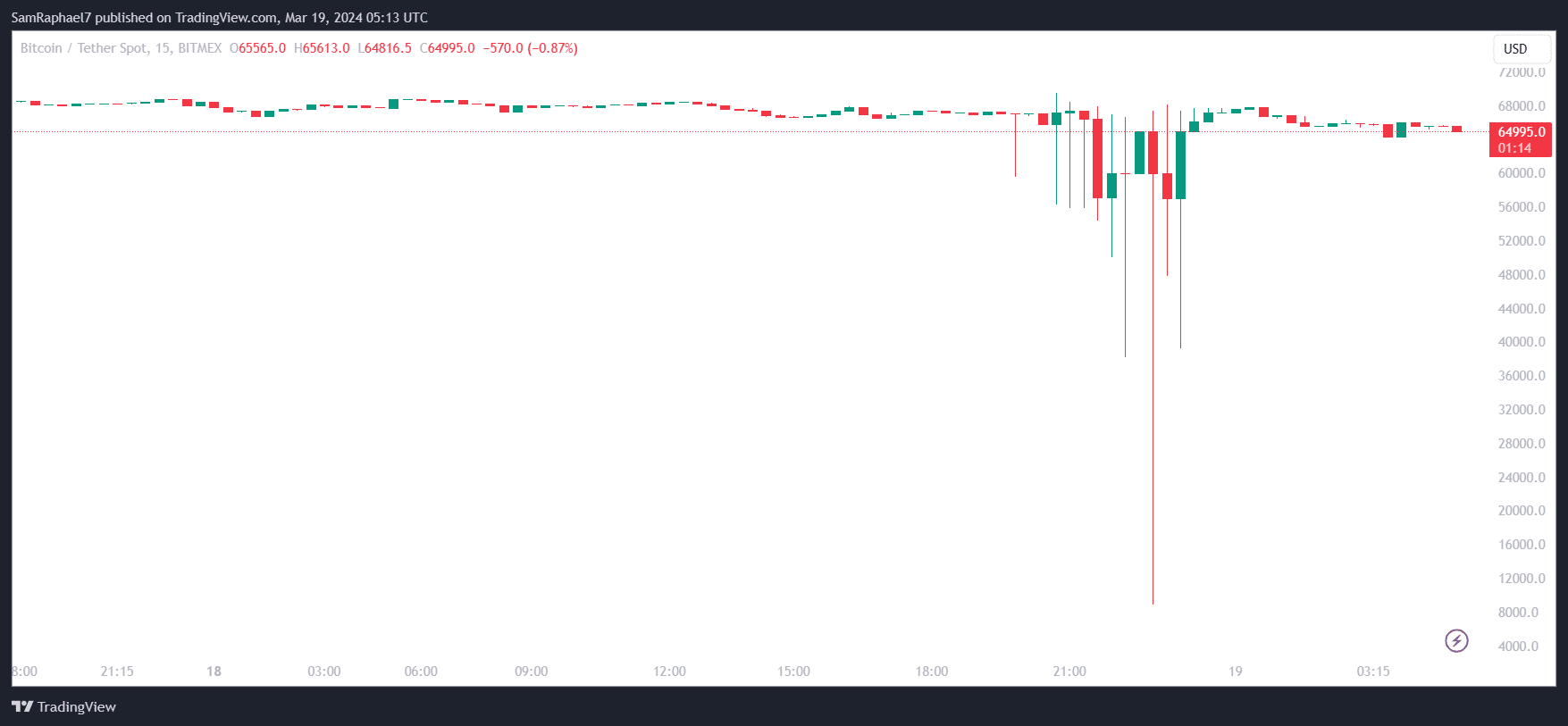

The price of Bitcoin crashed by as much as 87% from the value of $68,398 to a shocking low of $8,900 on the BitMEX exchange following a large sell order.

Market data confirms the crash, which occurred yesterday at 22:30 (UTC). Notably, the crypto asset started exhibiting unusual price movements from 20:00 on BitMEX, slumping to a low of $59,570, while the price remained above $66,000 across other exchanges.

Bitcoin Records Abnormal Slumps on BitMEX

The abnormal price actions persisted on BitMEX for over two hours as Bitcoin continued to record lower values below the $60,000 mark. It collapsed to a low of $50,000 at 21:45 and further slumped to $38,200 fifteen minutes later. Each drop was followed by a recovery to normal levels.

Following a pushback above $64,000, Bitcoin witnessed a much sharper crash, dropping to as low as $8,900 at 22:30. This price marked an 87% collapse from Bitcoin’s opening price of the day. Interestingly, the last time BTC saw the $8,000 price level was in April 2020, months before the 2021 bull run.

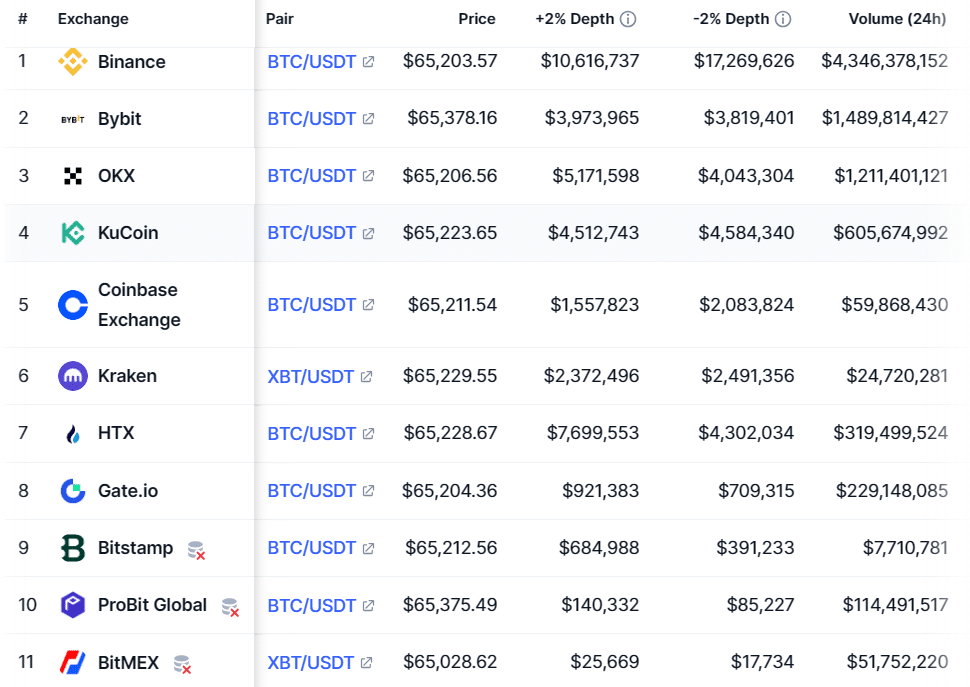

Bitcoin again recovered from the drop to $8,900, but the unusual price movements persisted for thirty more minutes before normalcy was restored. Despite trading at normal levels now, the price of BTC is slightly lower on BitMEX, currently sitting at $65,028 with at least a $200 discount.

Cause of the Crash

Chinese blockchain reporter Colin Wu called attention to the anomalous price movements earlier this morning. Citing Blockchain Daily, Wu confirmed that the price actions were due to a rapid sale of 400 BTC (currently worth $26 million) on the Bitcoin spot market on BitMEX.

A user sold more than 400 BTC on the BitMEX exchange, causing the price of BTC in BitMEX to fall to $8,900, it has now returned to normal, according to @blckchaindaily. BitMEX responded that it is investigating unusual activity involving user selling large orders in the BTC-USDT…

— Wu Blockchain (@WuBlockchain) March 19, 2024

The individual in question sold the assets at extremely low prices, impacting the market stability on BitMEX. The large volume of transactions around these low prices triggered a collapse in Bitcoin’s value, which was possible due to the lower market depth on BitMEX, currently at $25,669.

For context, the BTCUSDT pair on BitMEX has the lowest market depth among the top 40 pairs on CoinMarketCap. This low liquidity makes the market more susceptible to manipulation by traders with substantial resources who can execute orders that move the price in their favor.

In a statement, BitMEX emphasized that they are investigating the incident and confirming the execution of large sell orders. However, they stressed that the unusual price movements only occurred on the spot market, with the derivatives market unaffected. As a result, the market recorded no liquidations because of the anomaly.

thecryptobasic.com

thecryptobasic.com