Crypto market analyst EGRAG forecasts a potential timeline for XRP to attain its peak value within the current market cycle, envisioning a new all-time high exceeding $3.84.

Discussions surrounding XRP’s price action have centered on its inability to record as much growth as the broader crypto market. For context, while Bitcoin (BTC) is up 52% this year and Ethereum (ETH) has gained 39%, XRP is down by 13% within the same timeframe, having dropped to seventh place among the top 10 largest crypto assets.

However, market analysts such as EGRAG stress that this unique bearish trend for XRP is not a new phenomenon. In his latest analysis, EGRAG called attention to two phases XRP faces in every market cycle, with each phase determined by the crossover of the 21 and 55 moving averages (MA) on the 2-week timeframe.

#XRP This Time Is Different – 9th of September 2024

🔍 Examining the behavior of the 21 EMA and 55 MA on the 2-weekly timeframe.

📊 Definitions:#Bearish Cross: 55 MA crosses 21 EMA#Bullish Cross: 21 EMA crosses 55 MA

🔄 Cycle A:#Bearish cross to #Bullish cross: 574 days… pic.twitter.com/pa49S7NiSZ

— EGRAG CRYPTO (@egragcrypto) May 5, 2024

Notably, whenever the 21 MA crosses below the 55 MA, it signals an imminent bearish trend. However, when the 21 MA crosses above the 55 MA, this crossover points to a looming bullishness. Citing historical data, EGRAG spotlighted these crossovers during the last two cycles and the durations for each of them.

XRP’s Historical Trends

In Cycle A, which began in 2016, the 21 MA crossed below the 55 MA in the first quarter of that year, leading to bearish price actions which persisted for 574 days. After this, the 21 MA crossed above the 55 MA, signaling an imminent bullish move. Following the bullish cross, it took XRP 294 days before it hit its cycle top of $3.84.

Cycle B began in Q1 2019, with the 21 MA again crossing below the 55 MA. Expectedly, this cross resulted in bearishness that lasted for 658 days. However, the bullish crossover re-emerged after these 658 days, eventually flipping the momentum. After the bullish cross, XRP spent 140 days in consolidation before hitting the cycle top of $1.96 in April 2021.

XRP currently trades in Cycle C, which started in the second half of last year when the 21 MA moved below the 55 MA. This has resulted in XRP’s persistent underperformance since August 2023. Interestingly, after this, the 21 MA crossed above the 55 MA, but XRP has remained in consolidation for 154 days without reaching the top for this cycle.

XRP Could Hit This Cycle’s Top in September

EGRAG pointed out that XRP has surpassed the days it took to reach its top in Cycle B (140 days) but has not exceeded that of Cycle A (294 days). As a result, he believes XRP is mirroring Cycle A. If that is the case, XRP could hit its peak price for this cycle in the next 140 days, placing it on Sept. 9.

In addition, while XRP failed to surpass the $3.84 all-time high in Cycle B, EGRAG expects this cycle to hold a more bullish result. According to him, if XRP does not reach a cycle top above its current all-time high by Sept. 9, then it is taking an entirely different trajectory this time.

Interestingly, XRP is already observing an increase in bullish sentiments, according to derivatives data from Coinglass. With a 6% increase in Open Interest to $580 million over the last 24 hours, the long/short ratio has risen to 1.0657, indicating that traders are betting more on an XRP price increase in the short term.

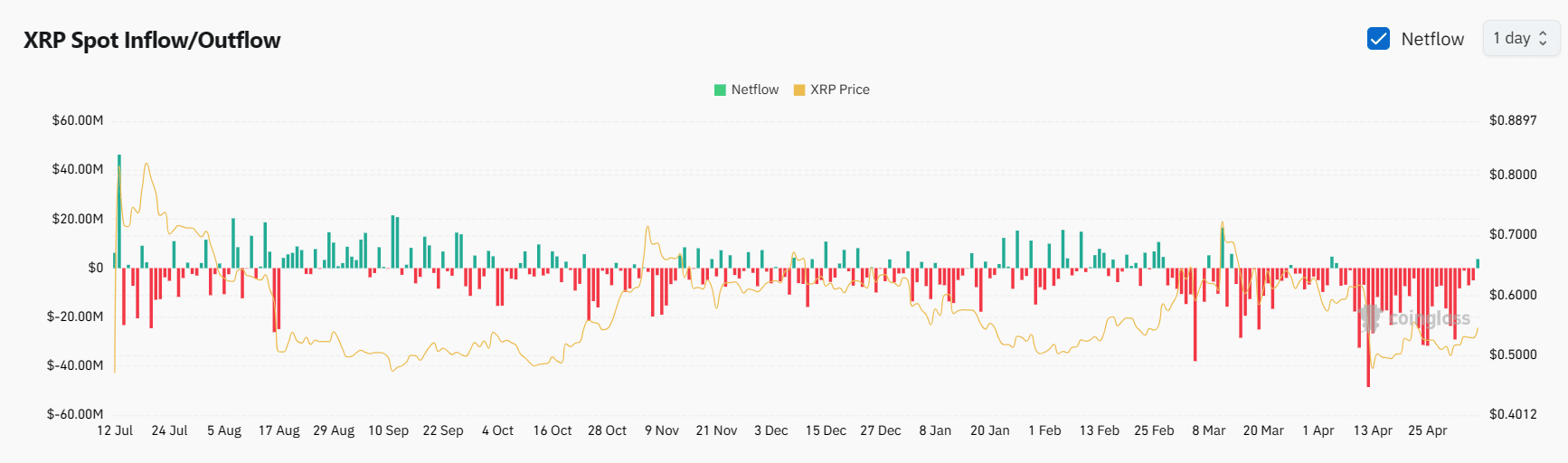

More remarkably, investors have been pulling off their XRP tokens from exchanges, possibly for long-term storage in self-custodial solutions. These investors have withdrawn over $477 million worth of XRP from exchanges since April 6. On April 12 alone, over $48 million in XRP was taken off exchanges, marking the highest negative netflow this year.

Meanwhile, XRP currently trades for $0.5462, up 9.15% this month. XRP is currently flirting with the 20 EMA at $0.5488 on the monthly timeframe, looking to leverage a break above it as the springboard to more substantial gains.

thecryptobasic.com

thecryptobasic.com