Crypto Trading and Regulation: The Present and Future of India

The cryptocurrency market of India is going through a whirlwind of changes. The crypto enthusiasts and buyers in the country are in limbo after a flat 30% flat tax was implied on profits on the income of all virtual digital assets, including crypto, starting April 1. Following the imposition, all the India-based exchange's trading volume tanked to almost half or worse.

Gleaning from several market tracking tools, we see a sudden slump in daily trading volume across exchanges immediately after the tax. For example, WazirX, one of the largest crypto exchanges based out of India, trading volume dropped from $90.31M to $27.23M from April 4 to April 10. Another India originating crypto exchange, CoinDCX, trading volume also halved from $15.10M to $7.91M in the same timeframe. However, tax shouldn't be held responsible for the slump. During the week, India experienced two critical incidents that raised the authorities' eyebrows.

The CoinBase and UPI Feud

CoinBase, one of the biggest crypto exchanges on earth, unrolled its trading services in India on April 7, 2022. Offering over 157 crypto assets from day 1 on its app-based service, CoinBase tipped users could buy crypto with the Indian rupee via the state-run Unified Payment Interface (UPI), an indigenous digital money transfer gateway. CoinBase Chief Product Officer, Surojit Chatterjee, claimed that CoinBase talked with several banking partners to ease the crypto assets buying experience through INR.

The claim immediately became a headliner since other existing exchanges struggled to enable UPI services for a while. Within hours, the state-run National Payments Corporation of India (NPCI) came back with a statement reading,

"With reference to some recent media reports around the purchase of cryptocurrencies using UPI, National Payments Corporation of India would like to clarify that we are not aware of any crypto exchange using UPI."

https://twitter.com/NPCI_NPCI/status/1512091446865633285

Aligning with the norms, CoinBase has withdrawn UPI payment facilities for crypto assets purchased from its app on April 10, 2022. Following the strong statement from the authorities, Mobikwik, the sole Indian payment service provider, stopped offering its e-wallet service to six digital exchanges it has partnered with.

The unavailability of UPI payment shook the daily crypto trading volume in the country as the majority of the Indian buyers preferred to deposit money to various crypto exchanges via the UPI payment facility only.

The Fund Struggle

Following the NPCI tweet, several Indian banks have stopped offering UPI services for depositing money on the crypto exchanges. Consequently, all the India-based crypto exchanges have temporarily withdrawn the UPI facilities and left their users with two options- National Electronic Funds Transfer (NEFT) and Immediate Payment Service (IMPS). The NEFT and IMPS services offer money transfers only between two India-based bank accounts, meaning the deposit would only be credited to the crypto exchange bank account, which they would later be held accounted for.

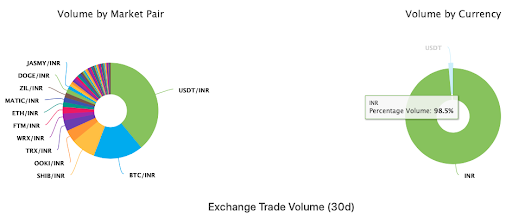

Interestingly, most Indian traders trust more trading through INR only than other available options. Looking at the Exchange Trade Volume Distribution chart of India's biggest exchange WazirX on CoinGecko, we see 96.7% of its buyers prefer INR rather than USDT and home-brewed crypto coin WRX. The buyers prefer depositing cash on exchanges for trading instead of transferring money through P2P. In P2P trading, a buyer receives an equal USDT or Bitcoin in exchange for INR after transfer.

Following the war-like situation, inflation, and several other reasons, the recent plunge in Bitcoin and Ethereum pricing has resulted in sliding in crypto trading globally. And Indian market, too, has a mirroring impact on the global fall. However, the latest hindrances, including UPI unavailability and an arduous tax slab, is the most significant reason behind it.

Government’s Concern

For the past few years, the Indian Government has been in a conundrum concerning crypto trading. On several occasions, Prime Minister Narendra Modi and Finance Minister Nirmala Sitharaman have lauded the virtues of blockchain and sought a global regulation to outshine the ongoing scams, money-laundering, terror funding, black-marketing and rug-pulls. But the Reserve Bank of India Governor is highly skeptical of cryptocurrencies. He has forewarned the Indian buyers that cryptocurrencies don't have any underlying assets and claimed that the VDA could threaten the country's financial and macroeconomic stability.

The Government's concern over scams and frauds involving cryptocurrency is alarming in the country. According to reports, over 9.6 million Indian users visited various phishing sites in 2021 alone. Being the second most country in crypto buying, several Indian users are still unaware of the underlying risks and vulnerabilities, and the Indian authorities are highly concerned about it.

Scam involving money laundering through cryptocurrency is another distress for Indian authorities. Recently an online job scam worth roughly $39 billion was busted by the Uttar Pradesh Police. The money was laundered via several cryptocurrency exchanges to countries including China, the Philippines, and Vietnam. The scamsters send millions of messages claiming to offer jobs in exchange for money via WhatsApp and several other messaging platforms. In most such cases, the money gets forwarded to unhosted wallets.

To mitigate illegal crypto trading, money laundering, and related transactions, the Indian Computer Emergency Response Team (CERT-In), a unit of the Ministry of Electronics and Information Technology, has issued an instruction for the crypto exchanges, VPN service providers, and data centers to archive all the user KYC for five years. All the crypto exchanges and VPN service providers are asked to report any cybersecurity incident within six hours and directed to transfer related data to the authorities.

At the International Monetary Fund (IMF) spring meeting, Indian FM Nirmala Sitharaman asserted her concerns over the involvement of unhosted wallets for money laundering and terror funding. For the uninitiated, unhosted wallets are privately hosted and not by any financial institutions or banks. Contemplating her previous statement, she voiced her support for global cryptocurrency regulation.

"Regulating cannot be done by a single country within its terrain through some effective method," she uttered. "And for doing it across borders, technology does not have a solution which will be acceptable to various sovereigns and, at the same time, is applicable within each of the territories," she added.

Speaking with the faculties and students at Stanford University, California, she expressed that the Indian Government is in no hurry about its stand regarding cryptocurrency but will encourage technological innovations around blockchain and distributed ledger technologies. She has added that the Government is optimistic about addressing the efficiency, transparency, and better management in cross-border payments via its own CBDC, which is about to get rolled out pretty soon.

Impact of Blockchain Ventures

A band of Indian blockchain players is working on several utilities such as Trade Finance, Cross-border Payments, Supply Chain Financing, Digital Identity, etc. Alongside a few Indian banks, business conglomerates and stock exchange are also considering the scope of blockchain in the country.

Indian blockchain startups Polygon (Matic), InstaDapp, Signzy, KoineArth, etc., are doing pretty well in the space and promoting the potential of blockchain technologies globally. Indian crypto startup CoinDCX has garnered $136 million in funding and has a current valuation of $2.15 billion. Anderseen Horowitz, aka a16z, has invested $260 million in CoinSwitch Kuber and has expressed investing another $500 million in Indian Unicorns. CoinBase'sCoinBase's venture capital unit has already invested $150 million into web3 startups, including CoinDCX and CoinSwitch Kuber. They have also expressed investing further in non-fungible tokens (NFT) and India's decentralized finance (DeFi). CoinBase CEO and co-founder Brian Armstrong have recently said while unveiling the CoinBase India trading platform that the company is eyeing a "long-term game" and would strengthen its workforce going forward.