New Fidelity Investments Service Or How Trillions Will Come To The Crypto Market

Institutional investors have been awaited for a long time in the crypto space. Holders of large capital should breathe new life into the market, which has been in a bearish stage for almost a year, and make it more liquid. Traditional and blockchain companies develop and offer new financial instruments and services to make investments in cryptocurrencies as convenient as possible for institutions.

The international financial conglomerate Citigroup will issue similar to ADRs digital assets receipts, which will allow clients to invest in Bitcoin directly while eliminating the necessity to own and store the underlying coins on their accounts. Goldman Sachs is developing a non-deliverable forward on cryptocurrencies, and Morgan Stanley plans to offer its customers the opportunity to to take short and long positions using the so-called price return swaps. While new derivatives will make investment in crypto more accessible, insurers promise to provide the proper level of security. The British insurance giant Lloyd's cooperates with the American custodian Kingdom Trust, and insures crypto assets of customers of the cold storage service.

But why do investors continue ignoring cryptocurrencies then? Because they do not see prospects in their further development, do they? The analytical company Greenwich Associates got concerned by the same questions and decided to sort things out. It interviewed executives of more than 140 organizations, including asset managers, hedge funds, brokerage firms and investment banks, on the subject of what they think of crypto assets. 70% believe that cryptocurrencies will become part of the institutional investment portfolio in the future. At the same time, 38% of them consider that digital assets will be regulated, and this will lead to further growth and innovation in the industry. The other 32% think that, like the dot-com bubble, some cryptocurrencies will survive and thrive, while others will cease to exist.

So digital assets can still be an attractive investment. One of the world's largest providers of diversified financial services, Fidelity Investments, believes in this as well and therefore decides to launch a new division - Fidelity Digital Asset Services. On October 15, the company announced that it will start providing custody and trade execution services for digital assets to institutional investors such as hedge funds, family offices and market intermediaries.

The trade service involves the use of an internal crossing engine and smart order router, which will execute transactions at several third-party cryptocurrency venues. In other words, the company directly connects customers with existing exchanges, where they can choose the most profitable offers, but the company takes over the most risky part of the registration and conduct of transactions and storage of assets.

Fidelity is committed to make cryptocurrencies and digital derivatives transactions as accessible as traditional assets. “We expect to continue investing and experimenting, over the long-term, with ways to make this emerging asset class easier for our clients to understand and use", — says Chairman and CEO of Fidelity Investments Abigail P. JOHNSON.

The company with a 72-year history is in the top 5 largest financial holdings and manages assets of $7.2 trln worth. The company's client base includes 13,000 institutional and 27 mln individual investors. Every year the company allocates $2.5 bln for the development of new technologies. Fidelity has been showing interest in the crypto industry since 2013 — that's when it launched its own blockchain incubator. Since then, the organization has managed to open its mining center, where it conducted the research first and then started to mine virtual coins. And it also concluded an agreement with Coinbase so that its clients gained the opportunity to keep an eye on their Coinbase balances on its website. This year In May Fidelity in conjunction with the MIT Media Lab's Digital Currency Initiative organized and hosted the summit on the problems and new solutions in the issue of the protocols scalability. Meanwhile within the framework of its charitable organization, Fidelity began to accept donations in cryptocurrency, collecting $69 mln in digital assets in 2017 alone.

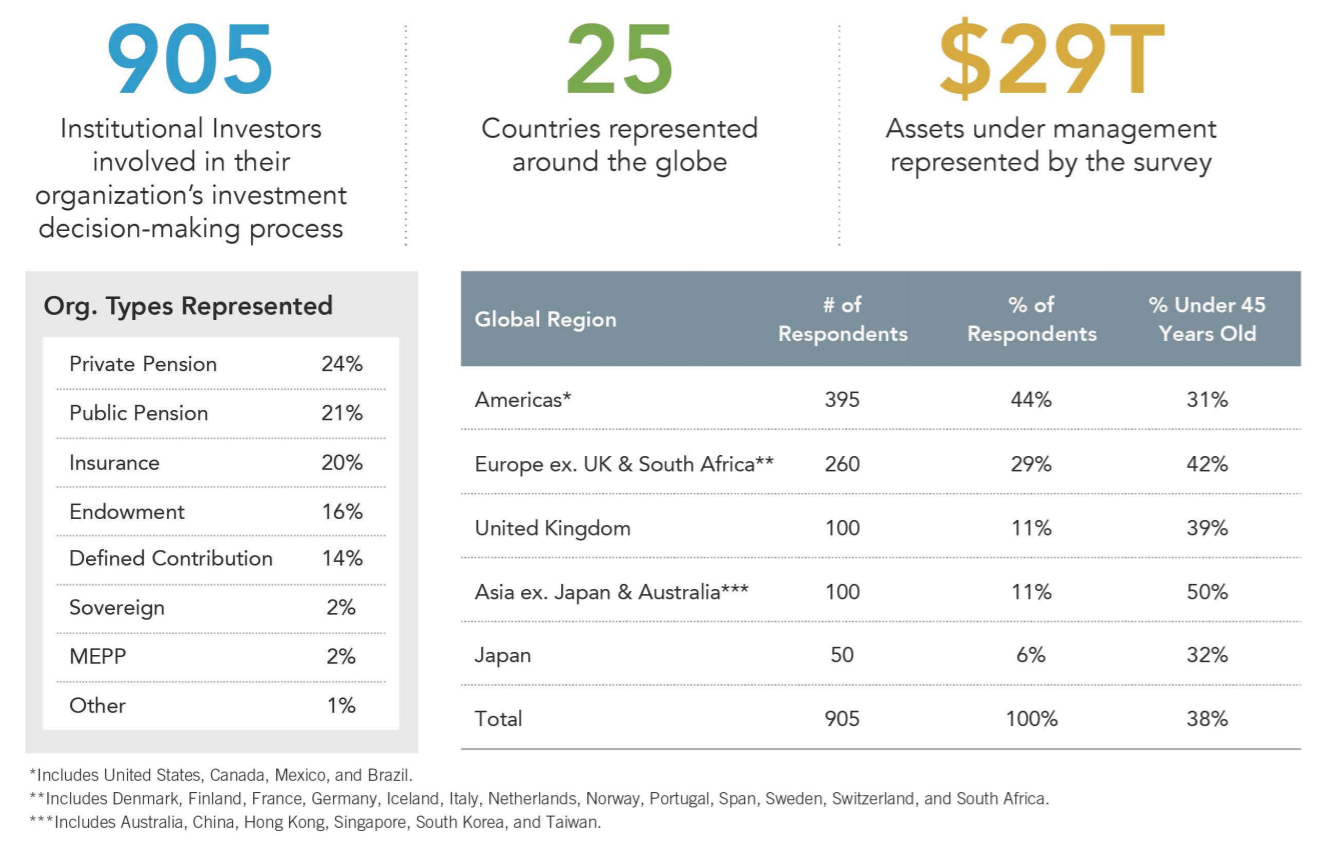

However, the new project is a much more serious step in the direction of the crypto market for Fidelity. As noted by the organization itself, the new asset class is of interest for institutional investors. The latest Fidelity Global Institutional Investor Survey, whose respondents were 905 investors in 25 countries, including pension, insurance companies and financial institutions, showed that 70% believe in the further development of cryptocurrencies and associate it primarily with the advancing blockchain technology.

The surveyed investors manage assets of $29 trln worth, which is 2900 times more than the volume of assets managed by 370 crypto funds. If we assume that 70% of institutions with a positive attitude to crypto assets allocate at least 1% of their investment portfolio for digital financial instruments, the capital inflow to the industry will be $203 bln, which is almost equivalent to the current volume of the crypto industry — $207.9 bln on October 19. In other words, if the doubling of the market is possible only through the single capital of the institutions that participated in the survey, then in practice the infusion of institutional capital may be even more significant, which will lead to a greater market growth.

The investor and co-founder of the consulting blockchain company Mario NAWFAL notes that in the short term the market may not react to the arrival of such a serious player, as the bearish trend is still going on. "However, this is irrelevant, the trends should be looked from a macro viewpoint, focusing on the long run. Fidelity’s entry is another event which is likely to add to the FOMO that will be experienced by institutions, similar to what we experienced last year with retail investors", - our expert believes.

The fear of missing out profits is strong in the investment world, and our other expert confirms it. "Crypto is more in the news headline than any top world politician or any war or natural disaster. As investor you don’t want to be not relevant, your ego is driven by the investment market! Today they say crypto is a fraud and bubble and the next day they are the first to buy crypto", - doctor of economic sciences and co-founder of a fintech company Michael LEE tells us.

Investors are also attracted by the potential of digital currencies to provide cheaper global payments, and the lack of close correlation with traditional assets. "Investors like to diversify their investment as they follow the rule never to put all eggs in one basket", - continues Dr. LEE. And this is despite the fact that the level of volatility of Bitcoin has reached a multi-month low, and at the moment the possible return on crypto investments may not be as significant as, for example, in the winter of 2017. If an investor managed to invest in September last year, then in December the profitability of his investments could reach 450%. At the moment, such a scenario is impossible. Moreover, history shows that large capital inflows only stabilize the market.

However, the first brave souls, who decide to invest in digital assets now, will be able to get income when there will be a mass arrival of all other institutions. On top of that, the Bitcoin offer is limited to 21 mln, and when all the coins are mined, the value of the virtual currency may perform even a greater rise.

If it's not about the potential of digital assets, then what continues to deter institutions from making substantial investments in the crypto market? There are two factors.

Firstly, the most pressing issue remains how — if institutions decide to acquire digital assets for their clients — these assets will be stored. They function as cryptographic media whose keys, after being lost or stolen, make them inaccessible and non-recoverable. Institutional investors are not accustomed to being the direct holders of assets and to taking care of how they are held. In the traditional investment field, these responsibilities are assumed by trusted institutions. Therefore, until now, cryptocurrencies have remained a confusing financial instrument for large capital holders.

Custodial services for such types of assets should be particularly technological but based on sound financial principles and be as reliable as for traditional assets. A number of companies have already presented their custodial solutions for large investors. Thus, the D3ledger software provider together with the AddCapital investment fund are testing a distributed system of payments and storage of digital assets with the possibility of restoring access to funds in case of keys loss. The decentralized depository is based on the Proof-of-Stake consensus algorithm, where the network nodes are the Central Securities Clearing Corporation of Slovenia (KDD), the National Settlement Depository of Russia and the Swiss fintech startup Lykke.

The developers point out that the identification of users with the help of network nodes will be able to guarantee not only the security, but also the transparency of data provided to regulators.

In turn, the custodial services from Fidelity are more traditional. The company offers its customers to keep Bitcoin, Ether and other crypto-assets in physical repositories that are not connected to the Internet, which will eliminate the possibility of a hacker cyber attack. Moreover, cold storage will be geographically distributed, which minimizes the risk of hacking. "It is too early to comment on the security of the custody model however when it is proven, this could be a catalyst for significant capital inflows into the space", - believes Mario NAWFAL. The same opinion has the Director of the investment company Galaxy Digital Mike NOVOGRATZ: "Fidelity new business will probably be up and running in January, or Q1 of 2019. And then you have to run some water through the pipes, so my guess is you will start seeing institutional flows into pure crypto assets in late first quarter or early second quarter”. By the way, the company of NOVOGRATZ became the first client of the Fidelity custodian. On top of that, together with the investment bank Goldman Sachs it supported another custodial project, BitGo Trust, investing $15 mln. In September, the startup received an approval from regulators and became a qualified custodian offering secure storage services for Bitcoin and 74 other digital currencies and tokens using a multi-signature technology. According to the company, it has already stored assets of more than $2 bln worth.

The second deterring factor is the remaining low degree of regulation of the crypto industry. The main decision is now expected from the SEC. "I think it will happen in the first quarter of next year. When the SEC allows ETF trading, most part of cryptocurrency market will become more regulated and accepted and become the new asset class. What I mean is it will be traded like gold and other commodities", - says Dr. LEE. The expert continues: "The positive decision by the SEC, which we all expect, will trigger opening of trade in Europe and Asia as well. So early next year there will be take or break for crypto market. If the SEC opens the market for ETF and bond crypto trading, we are talking about 100’s of trillions of US$ to come".

In order to push the SEC to a positive decision, more and more companies need to bring strong technologies and products to the market. Goldman Sachs and JPMorgan Chase are working in this direction, and after the arrival of Fidelity Investments there will be even more companies, our experts believe. "The major mistake made by the crypto movement was that it tried to fight with the established system from the outside. To win the heart and mind of people, you need to enter the system, show them the advantage to do changes and by educating them get the change you like to see. You don’t run and try to break a wall with your head, but rather come up with a top product and show its benefits to the people you want to sell to", - concludes Michael LEE.

There is every reason to believe that with new high quality products and regulated infrastructure, the crypto space will be able to attract large capital, but it will take some time. The statement by our expert Mario NAWFAL perfectly suits the existing situation: "Patience is seriously lacking in crypto, more than in any other hype in the history, and those who can recognize this have an edge”.