NEAR: A Good Example of the "Coinbase Effect"

The "Coinbase Effect" is a famous phenomenon that causes asset values to rise when new listings are revealed. The economic reasoning behind the impact is simple. When a cryptocurrency is put among prominent exchanges, it receives instant access to a new group of market players.

One of the top exchange platforms, Coinbase, declared on August 10 that NEAR would be added to its listing plan. This implied that cryptocurrency was currently one of the assets the marketplace intended to make accessible through its platform.

Following the statement above, it had an immediate chart uptrend and posted an intraday gain of 12%. It reached a high of $6 before changing hands at $5.887. Usually, when a cryptocurrency is listed on Coinbase, the price increases. Does a possible listing, however, have an equivalent impact?

Is there truth to the Coinbase effect?

Since the statement was issued, only 6% more money has been spent on NEAR. The alternative appreciated 28% in July due to the bullish retracement in the overall market. NEAR had increased 25% before the announcement. Following the rumor that Coinbase planned to add the token, the alternative's price increased by 12%.

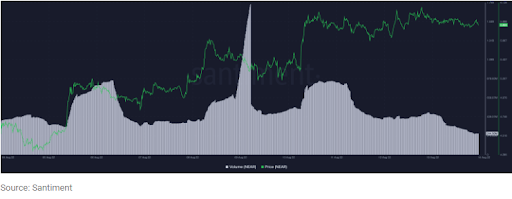

NEAR's price has dropped to its range before the news at $5.89 as of press time. In addition, NEAR had vigorous trading activity on August 11. The intraday trade volume on the platform increased to a high of over 845 million in a day due to Coinbase's statement. However, trade activity began to slow down just before the trading day ended. Trade volume on the platform was 244.559 million at the moment of writing, dropping by more than 200% in only four days.

Is the issue NEAR?

Consider OOKI, the token issued by Ooki Protocol while determining if a possible listing on Coinbase will boost a coin's value. On August 12, it was also placed on the exchange's listing schedule. Following the release, it saw a 29% day trade surge and traded for as much as $0.00869.

The cryptocurrency has lost 11% of its profits from the date above and is currently trading at $0.007657. Additionally, the altcoin's trading volume increased significantly during the past two days. However, it immediately began to decline in the charts.

Roberto Talamas of Messari examined the performance of various tokens over the first five days after their Coinbase launch in a paper from 2021 titled "Analyzing the Cryptocurrency Exchanges Pump Phenomenon." According to Talamas, the average price of tokens posted on Coinbase increases by 91% during the first couple days after the listing.

However, he pointed out that not all tokens were impacted equally by the Coinbase listing and might have a beneficial effect on asset returns. The price surge when NEAR was listed is anticipated to be brief. A price decline is anticipated a few days following the listing, much like earlier currencies traded on the market.

Various effects of Coinbase listings

- Liquidity

The coin's liquidity also gets a significant boost as more people are now exposed to it. The market capitalization will also go up, placing it in a better position on CoinMarketCap. This serves as a significant boost to the coin's ego, as well as to the team working on the project, and might eventually lead to more investors putting money into it.

- Increase in the Price of the Token

The long-term effects of a Coinbase listing are also positive and might lead to an increase in the price of the token. Some of these long-term effects include an increase in the number of wallets that support the token and an increase in awareness and recognition of the project. The wallet factor poses advantage in that it increases the possibility of more people holding on to the token for a more extended period, making it easier for them to transact with it.

- Interest of other exchanges

Another long-term advantage is that it might lead to more exchanges listing the token, which would relatively also increase its liquidity. This is because more people would be aware of the token, and as a result, more exchanges would want to list it to capture the increased demand.

- Increased popularity on other platforms

It could also pave the way for the token to be listed on major exchanges, such as Binance or KuCoin. This is due to the increased awareness and recognition that a Coinbase listing brings. Coinbase has also been known to help with the price discovery of a token. This is because when a token is listed on Coinbase, people can buy it directly with fiat currency. This exposes the token to a new group of potential investors who previously could not invest in it. Being listed on these exchanges would lead to an increase in the trading volume of the token, as well as its price.

All these factors considered, there is some truth to the Coinbase effect. Listing on the popular exchange does provide a short-term price boost for the token. However, it is essential to note that the effect is not always long-lasting and that the price could drop soon. Investors should, therefore, be cautious when making investment decisions and should not solely rely on the Coinbase listing as a reason to invest in a token. They should research to ensure the token is an excellent long-term investment before making any commitments.