Effective Tools for Earning on the Crypto Market in Q4 2022

Today, the cryptocurrency market offers many options for earning money with different levels of risk. You can invest in new crypto projects, buy fundamental cryptocurrencies for holding, engage in trading or mining, earn on staking – this is only a small part of what the current market is ready to offer.

However, with the onset of the bearish market cycle, the prices of the cryptocurrencies began to fall. Starting from November 2021, the market began its gradual weakening and some of the above-mentioned instruments lost profitability or became more risky.

Market overview

In November 2021, Bitcoin hit $68,000 and set a new price record. But after reaching the peak, the crypto asset became inseparable from red candles and began to lose value. Traditionally, the main cryptocurrency pulled down other coins, which led to a decrease in the total market capitalization from almost $3 trillion to less than $1 trillion. At the beginning of November 2022, the price of BTC averaged $20,000-22,000 – a drop of more than 3 times hurt those investors who purchased the main cryptocurrencies from the top 50 at the end of 2021. And, due to current events, it’s still descending.

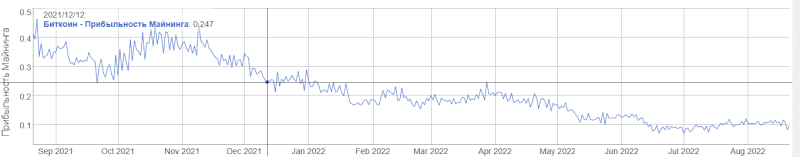

The price downfall of the major cryptocurrencies has also weakened the profitability of mining, which has always been perceptive as a popular way to earn on the cryptocurrency markets. Mining has become much less profitable, despite the fall in complexity of crypto networks. Concerning Ethereum mining, it became completely impossible due to the transition of ETH to a new algorithm without PoW.

The payback of the newest and most profitable mining equipment – Bitmain Antminer E9 (2.4Gh) – can reach +/- 8 months, aimed at mining ETH forks. A year ago, in November, such equipment would pay off for 4 months. With Bitcoin miners, the average ROI exceeds 1 year at the current BTC price of ~ $17,000-20,000.

Another popular way to make money is investing in newly launched crypto projects. It has not lost its profitability, but has become much more risky. Tokens of new projects now risk losing value under the influence of a bearish trend that has been dominating the market for more than a year. Also, the events of 2022, with the collapse of large projects such as Terra or FTX, further discourage investors from taking action.

The current state of the market pushes many people to be concerned about a simple question: is there a stable and reliable way to make money on cryptocurrencies when the entire market is descending?

How to earn on cryptocurrencies during current markets

The most relevant ways to earn on crypto are trading, arbitrage and staking. Experienced traders make profits on market movements, trading remains one of the most profitable ways to make money out of the crypto industry. Nevertheless, making money on trading and staying profitable demands remarkable knowledge and a deep understanding of the market. One should always consider that trading takes a lot of time, especially if it is intraday trading or scalping.

Inter-exchange arbitrage is also a time-consuming process. This activity suggests the purchase of cryptocurrency on one exchange with further sale on another one, where the rates are higher. Here you need to understand the issue very well and strictly control the whole process^ considering various costs, such as withdrawal fees. If you plan to earn on the price difference of the asset between the two platforms, it must exceed transaction costs and possible risks.

Cryptocurrency staking seems to be the most interesting and stable method to get profits – this is a passive way of earning, in which a certain number of tokens is locked, and your account acts as a transaction validator on the network. You can stake cryptocurrencies on the PoS protocol (Proof-of-Stake), if a project supports the staking function. However, it is important to remember that the rewards are paid out in the tokens that you stake – for example, staking a BNB token on Binance will be rewarded in BNB tokens. If we take this into account and the fact that the current market is dominated by bearish sentiment, then the profit from staking can be erased by a price fall of the cryptocurrency staked.

So we come to a conclusion that in the current market, the most stable and profitable way of earning is the staking of stablecoins, which is implemented in projects such as BITTIX Bot. As an example, Binance offers BNB staking at 13% per annum – while since the beginning of the year, the cryptocurrency price has dipped in value by more than 40%. Staking stablecoins means earning a cryptocurrency that is pegged to the exchange rate of fiat currencies – by staking USDT you can earn 4.5% every month in a coin pegged to US dollar.

Staking stablecoins is available on many platforms, and the interest on staking USDT or USDC can reach 7-10% per month, and the advantage of the BITTIX Bot service is a convenient usability in the telegram bot format. There is no need to register and pass through many steps such as KYC. You can just launch the telegram bot and get access to the staking platform and your own anonymous multi-currency crypto wallet.

Like other staking platforms, BITTIX Bot offers several types of staking with different conditions. You can choose an option with flexible withdrawal conditions; there is also a higher yield option with freezing funds for a year. A native interface and usability with access via telegram make the process of staking convenient for users. Your investments are secure: the BITTIX Bot project has obtained a crypto license in Dubai, while the smart contract protects accruing profitability on staking.

There is also a good bonus – an international transfer feature, with the possibility to withdraw fiat funds to the credit card in 150+ countries. So, you can earn on staking and make international transfers or withdraw funds almost anywhere abroad. Just try the Bittix Bot service – follow the link.

It is important to remember that investing in cryptocurrencies is risky, so regardless of the instrument of earning on the crypto market, remember to diversify.