What Strategy is Best for Crypto, Trading, or Holding?

Trendsurferssignala

While both strategies have their pros and cons, the right one for you will depend on your goals and temperament. This article will help you determine whether you should be investing in crypto for the long term or looking for more immediate returns by trading.

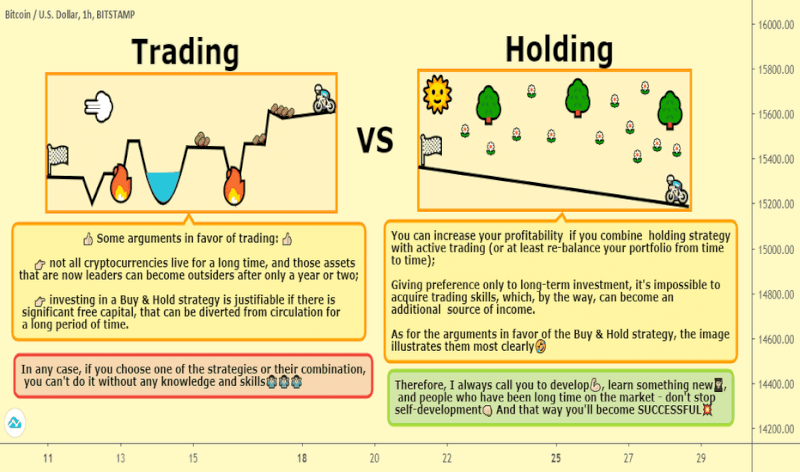

The Better Strategy Between Holding and Trading

Holding and trading are useful in different bitcoin trade situations. Although holding seems more straightforward for inexperienced crypto traders, it is logistically complicated. On the other hand, trading can be difficult, but it’s full of learning. Therefore, learning the dynamics of crypto trading can be helpful for new traders.

Tradingview

Let’s compare trading and holding to understand the winning option between them.

Holding Strategy

In a holding strategy, crypto traders will buy and hold their cryptocurrency through the ups and downs of a crypto cycle. This approach is laid-back with a probability of several errors. Typically, it’s pretty hard to pull off a holding strategy without enough experience with the bitcoin trade.

Generally, new investors are keen on buying and holding their cryptocurrency, hoping for a sudden rise in value when they could opt for trading it later. However, holders do not go for profits often, which is essentially the main problem with this strategy. Instead, they are more focused on holding the cryptocurrency in their wallets.

This strategy works well if you have an exit plan that ensures profitability when you withdraw your crypto assets.

Trading Strategy

In a trading strategy, crypto traders tend to trade their assets frequently. The idea is to grow their money and other crypto holdings quickly. Compared to holding, there is a greater risk if the strategy isn’t executed correctly.

Generally, most crypto traders are bad at trading. That’s because it’s a relatively new niche. However, if traders ensure a risk management plan, it can be a valuable option for their bitcoin trade.

If you want to take advantage of the market's volatility and make money by trading, you need to know the industry's trends and analyze them quickly. Trading strategies are best for those who want more control over their investments and want to manage their portfolio while making money off them actively.

Why Holding Is a Better Option

Holding keeps the investors from panic selling. Since crypto holders are not in a rush, they can make more profits after a big run.

On the other hand, trading has many risks attached to it. For instance, your coin may be doing well in the market before it suddenly receives a correction. Unfortunately, this fluctuation often leads new traders to buy at a higher value and sell cheaper. And since traders usually don’t have a risk management strategy, they end up with losses, eventually opting out of the bitcoin trade.

The following table shows a summary of the comparison between holding and trading.

| Holding | Trading |

| Holding is much simpler as you just have to buy the coins and keep them in your wallet. | Trading is more complicated and requires investors to have a technical understanding of their preferred coins. |

| There is no need for a risk management strategy. | Trading can be dangerous without a risk management strategy. |

| Holders are passive, so they are at a lower risk of losses. They are comfortable with playing the waiting game. | Traders tend to make huge profits one day and may end up with severe losses on a bad day. They can either sell at a high-profit time or go down by selling at a lower price. |

| You don’t need to pay taxes until you have cashed out the money from your crypto account. | You must tally your profit and loss with every trade. Taxes often eat a good chunk of your profits. |

How Can Traders Incorporate a Workable Strategy?

A suitable option for new investors will be to scale out some of their profits after they have made significant gains with their bitcoin trade. Then, they can go for holding for the rest of the profits to ensure stability.

The idea is to slowly average into position and then opt out when conditions are suitable. This approach can be an effective way to profit without much damage for beginners. But remember, you are eventually going to trade anyway. Hence, holding can make it slightly easier to understand the basics of the bitcoin trade.

Final Words

Crypto-trading and holding are both good strategies, but it depends on your personal preferences. If you’re a more adventurous investor who likes to play the market and take risks, crypto-trading is likely right for you.

If you prefer to be more conservative with your investments and are looking for long-term growth, then holding may be the best option for the bitcoin trade.