The Impact of Second-generation Cryptocurrencies on Banking

Since the advent of Bitcoin, over ten years ago, the cryptocurrency market has been very active, but mostly speculative. Many new currencies have been created, but not much has changed in their basic conception. Some cryptocurrencies are pinned to the US dollar to achieve stability, but may be susceptible to other problems.

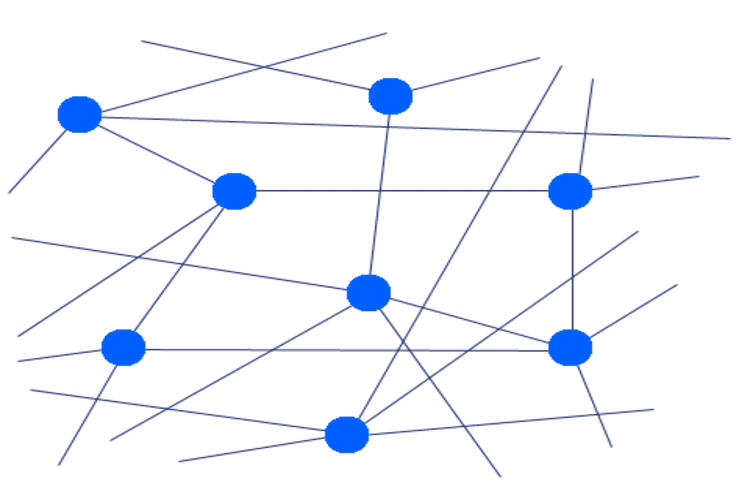

Bitcoin vs. USD Volatility (From: BuyBitcoinWorldwide)

We should not be surprised that, after 10 years of Bitcoin, most current fintech articles on cryptocurrencies consider blockchain technology as a fait accompli. The common assumption is that not much will change in the Distributed Ledger Technology (DLT), and the cryptocurrency world, in the next few years.

However, really disruptive changes are sudden. With the rate of acceleration of today’s technology, change is unpredictable and its impact is sometimes beyond expectations.

Distributed applications are still waiting for faster, scalable networks. Governments are not happy about the trends towards anonymity of their users. The ability of users to securely handle their keys and write secure applications is questionable.

Second-generation, stochastic cryptonetworks will cause a sudden change in public blockchain technology by moving from decentralization to distribution: What DLT technology was supposed to be, but never was. In stochastic cryptonetworks, every node has equal responsibility for the verification of transactions, network security, and block equalization.

Random sessions in stochastic cryptonetworks (© G.Gori)

These networks will not need intermediaries and rewards. Their basic transaction services will be free. More importantly, they will be faster, scalable, secure, and able to support applications that require the exchange of large amounts of data.

Stochastic cryptonetworks are described in my soon to be published book “Reinventing the Blockchain”, with a foreword by George Gilder. Stochastic cryptonetworks, and their corresponding cryptocurrencies, will have a marked impact on the banking and financial industry.

Stochastic cryptonetworks will disrupt financial services and provide the opportunity for new services, creating non-volatile cryptocurrencies and bypassing bank payment systems. Stochastic cryptonetworks will also disrupt distributed application development by providing a simpler model for general blockchain applications.

Current operating systems will morph into Distributed Operating Environments, including personal wearable devices, corporate servers, autonomous robots, and IoT devices, all cooperating to maintain current replicated data securely and immediately available on any of these systems.

Second-generation cryptocurrencies will be non-volatile. Simple movements of money will be free, just as we enjoy many other free services when subscribing to a plan for accessing the Internet. They will be an effective means of exchange with the potential of replacing fiat currency: people will be able to move money to each other easily and transparently without fees, just like moving cash, but with the added advantage of traceability, which is an insurance against theft and money laundering. Payment systems will be disrupted.

Second-generation cryptocurrencies will also be an effective store of value, because

- they will have no inherent inflation;

- prices, expressed in these currencies, will not be volatile; and

- people will receive directly into their wallets their share of proceeds from all earnings by the cryptonetwork.

For the above reasons everyone, including the world’s unbanked, will enjoy the use of a no-fee, interest bearing savings account (or wallet) maintained by their own tamper-proof personal device: a blockchain-registered device acting as a node of the cryptonetwork.

Such accounts will be recorded on the blockchain on every network device. Each device will be biometrically paired to its user. Users will not need to trust a bank, an exchange or an intermediary for holding their accounts.

Because of the ability to react to changes in currency demand in a precise and timely fashion, when second-generation cryptocurrencies will be widely used, the cycles of worldwide economic contraction and expansion will also be a thing of the past.

Furthermore, second-generation cryptocurrencies will not be deflationary.

While today cryptocurrencies are mostly a speculative instrument, this will end with second-generation cryptocurrencies, as they automatically will respond to changes in demand to maintain price stability. In addition, their short-term variations will be mathematically smoothed to avoid short term speculation by automatic means.

Daily Volatility (Forbes: Bitcoin volatility by the hour)

New generation cryptocurrencies based on stochastic cryptonetworks will positively disrupt the cryptocurrency market and cause a consolidation of the many types of cryptocurrencies in circulation today. For example, most current cryptocurrencies using leader-based consensus mechanisms (Proof-of-Work, Proof-of-Stake, Proof-of-Capacity or proof of anything else), may remain only as speculative instruments. These first-generation cryptonetworks do not respond to the expectations of cryptocurrency users, as users still need to trust verifiers/producers for the maintenance of the cryptonetwork.

Cumbersome mechanisms, such as two-factor authentication will become obsolete. Personal information will not be required to establish identity: personal information will remain private and secure, as it will not need to be transmitted. Private information will remain the property of each individual. Already existing quantum-proof encryption techniques will be standardized to replace current elliptic curve cryptography.

The newest biometric methods will be used for restoring one’s secure environment when personal devices are lost, stolen or damaged. Reputation systems will allow people to create and expand their own personal networks, including trading networks, social networks and a host of other distributed services.

The impact on banking will be multi-faceted. Probably the most important aspect is that lending institutions using second-generation cryptocurrencies will not be able to take advantage of fractional banking. That will be a guarantee of currency integrity.

Currently, a bank can loan a quantity of money to a customer independently of its reserves. However, cryptocurrency is uniquely traded and traced. For cryptocurrency to be lent out it must exist and must have been deposited in the lender’s account. The gradual disappearance of fractional banking will move the responsibility for controlling the liquidity of currencies from central banks to automatic cryptonetwork mechanisms.

Currently, we rely on government economic indicators for taking the pulse of the economy. We further rely on humans in central banks evaluating those indicators and suggesting corrective actions within a certain time frame.

Summary

In summary, the following will be important factors affecting banking:

- Security tokens, a corollary instrument created on a cryptonetwork over and above its native cryptocurrency, will continue to replace other forms of instruments for investments.

- Payments will not be any more an integral function of traditional banking.

- The FED and Central Banks will have a reduced influence on the economy, as new currency is automatically generated and distributed directly to users.

- Financial institutions will continue to evaluate and provide loans, but fractional banking will gradually disappear. They will be able to expand their services to customers by using virtual private blockchain networks; at the same time their customers will use public cryptonetworks for communication, payments and other public services.

- New government regulations will likely be developed to regulate exchanges and new services available with second-generation cryptocurrencies.

- The KYC function provided by local institutions or by specialized companies will still be necessary for the initial distribution of new personal, blockchain-registered unique devices and for the provision of new special services.

The projections presented in this article are based on the current design of a stochastic cryptonetwork (GNodes). The disruption of crypto mining, banking and current cryptocurrencies will be some of the most immediate side effects related to the fintech industry.

Society will benefit by being able to count on a distributed digital environment inherently secure, with verifiable contacts and reputable trading partners, convenient and fast distributed applications and many other services, making our lives simpler, safer, more creative and more enjoyable.

About the author

Giuseppe Gori is the CEO of Gorbyte, a blockchain research, development and innovation company. Gorbyte is developing GNodes, a stochastic, distributed cryptonetwork that uses MARPLE, a blockchain-based, distributed consensus protocol.