Wall Street has been invaded by Bitcoin mining companies. In the last three years, Bitcoin mining companies have grown massively. They are even starting to list on Wall Street as an emerging industry.

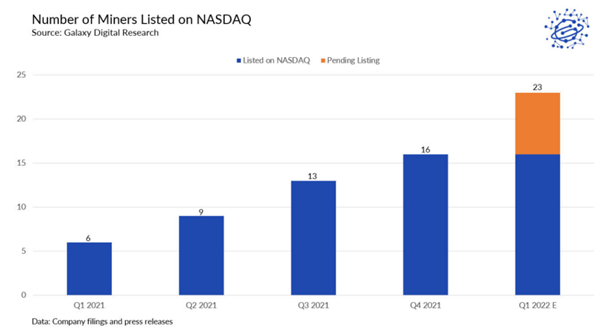

Statistics from Galaxy Digital Research give us concrete evidence that Bitcoin Mining is an attractive profitable industry. More and more Bitcoin mining companies are listing on the stock exchange.

The sheer number of Bitcoin mining companies listed on NASDAQ proves that Wall Street can no longer be indifferent to the attractiveness of the market.

In just two short years, along with the uptrend of the Bitcoin price, the number of listed Bitcoin mining companies also increased. There were six companies in the first quarter of 2021. To date, there are now 16 companies.

This number will jump to double that by the first quarter of 2022. There are currently 7 companies in the Pending Listing form.

Bitcoin mining has ceased to be spontaneous and concentrated on a few large companies. Instead, it has become more specialized, and the market share is more fragmented. Wall Street can hardly deny the lucrative appeal of Bitcoin mining.

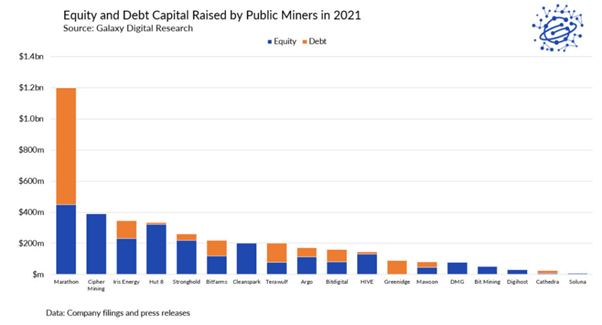

Look out Wall Street: Bitcoin mining is raising more capital than ever

The following chart shows the volume of coins raised by Bitcoin miners.

This number is no longer tens or hundreds of millions, but billions of dollars. As an example, Marathon Digital Holdings raised $1.2 billion.

These events have turned out to be a huge catalyst. This not only contributes to the sustainability of the Bitcoin blockchain network. It also attracts money from the traditional stock market to invest in the crypto market.

Incredible Revenue of Bitcoin Mining Companies

The revenues of Bitcoin mining companies have also had amazing growth.

Within a year, the revenue increased from 4 to 10 times. Which is nice work if you can get it.

Wall Street is poised to embrace crypto. Bank of America created a new crypto research team and enabled BTC futures trading for clients in July, Goldman Sachs teamed up with the cryptocurrency merchant bank Galaxy Digital to trade Bitcoin derivatives. BlackRock, the world’s largest asset manager, has also found digital asset futures contracts enticing.

beincrypto.com

beincrypto.com